- Doctors & Departments

-

Conditions & Advice

- Overview

- Conditions and Symptoms

- Symptom Checker

- Parent Resources

- The Connection Journey

- Calm A Crying Baby

- Sports Articles

- Dosage Tables

- Baby Guide

-

Your Visit

- Overview

- Prepare for Your Visit

- Your Overnight Stay

- Send a Cheer Card

- Family and Patient Resources

- Patient Cost Estimate

- Insurance and Financial Resources

- Online Bill Pay

- Medical Records

- Policies and Procedures

- We Ask Because We Care

Click to find the locations nearest youFind locations by region

See all locations -

Community

- Overview

- Addressing the Youth Mental Health Crisis

- Calendar of Events

- Child Health Advocacy

- Community Health

- Community Partners

- Corporate Relations

- Global Health

- Patient Advocacy

- Patient Stories

- Pediatric Affiliations

- Support Children’s Colorado

- Specialty Outreach Clinics

Your Support Matters

Upcoming Events

Child Life 101

Wednesday, June 12, 2024Join us to learn about the work of a child life specialist, including...

-

Research & Innovation

- Overview

- Pediatric Clinical Trials

- Q: Pediatric Health Advances

- Discoveries and Milestones

- Training and Internships

- Academic Affiliation

- Investigator Resources

- Funding Opportunities

- Center For Innovation

- Support Our Research

- Research Areas

It starts with a Q:

For the latest cutting-edge research, innovative collaborations and remarkable discoveries in child health, read stories from across all our areas of study in Q: Advances and Answers in Pediatric Health.

Frequently Asked Questions About Insurance, Billing and Payment

During your visit with Children's Hospital Colorado, we do our best to welcome you and ensure the best care for your child. We also want to try to make the billing and insurance process as seamless as possible.

How billing works

When you get care from us, we'll bill your insurance first. Any amount your insurance does not cover then becomes your bill.

How much your insurance covers depends on your plan, but most private insurance plans work in similar ways. Contact your insurance company for info about your specific network and plan.

In general, though, most private insurance covers certain services, like doctor's appointments and prescriptions, by copay, which means you always pay a fixed amount.

After your visit, please contact us with any questions regarding insurance, billing or payments. You can reach Patient Financial Services at 720-777-6422 if your question cannot be answered from the information below.

What to expect

Watch the videos below to learn more about what to expect from billing and insurance when you visit Children's Colorado for a scheduled appointment or a trip to urgent care or the emergency department.

Scheduled appointments

In this video, we explain what to learn about your insurance plan before you visit and how we work with you and your insurance provider. We also share what to expect when you receive and pay your bill after your appointment.

Emergency and urgent care visits

This video explains what to expect during and after your visit, how costs are calculated, options for financial counseling, and the process for billing and payment.

Your rights and protections against surprise medical bills

When you get emergency care or get treated by an out-of-network provider at an in-network hospital or ambulatory surgical center, you are protected from balance billing. “Balance billing” is sometimes called “surprise billing.”

To learn more about balance billing and get information about your rights and protections against balance billing, view this PDF document:

Your Rights and Protections Against Surprise Medical Bills – English (.pdf)

Your Rights and Protections Against Surprise Medical Bills – Español (.pdf)

I received a billing statement. How do I know my insurance company paid its portion?

If you have questions about insurance payments, please call your insurance company directly. The insurance company’s phone number is usually printed on the back of your insurance card.

Why is a portion of my bill covered by my insurance, while the rest is not covered?

Coverage can change every year depending on your benefit plan. This determines whether or not a patient’s bill is covered by insurance. Hospital coverage often has patient responsibility including deductible, copayment or coinsurance. Since each plan can be different, we encourage families to carefully review their benefits with their insurance company.

Should I inform my insurance company that my child is going to be in the hospital?

Most insurance companies require you to notify them before you have an inpatient or outpatient visit. Some visits will also require a referral from your primary care physician. We encourage you to check with your insurance company to find out the specific requirements for your insurance plan prior to your visit.

Do I need to have my insurance card or my child’s insurance card with me at the hospital or clinic?

Yes, it is very important that you bring your updated insurance card with you to ensure that we get the insurance billing information to accurately file your claim. You will be asked to present your card each time you register.

How do I know if Children’s Colorado accepts my insurance?

We accept many insurance plans. Please check with your physician to ensure that he or she is an in-network provider. You may have to pay additional costs for out-of-network services.

How do I know if my child’s visit will be covered by my insurance company?

Health benefit coverage varies with each insurance company or employer group. Please refer to your insurance member handbook or call your insurance company with questions regarding coverage for specific services.

What should I do if I think that my insurance company has paid my bill incorrectly?

If you disagree with the insurance company’s payment amount, contact the insurance company directly and ask them to review how the claim was processed. If the insurance company determines the bill was paid correctly and you still disagree, please contact your benefit manager with your insurance company. They can provide guidance on how to file an "appeal" with them. Filing an appeal will ensure that your claim will be reviewed for reconsideration.

How do health insurance co-pays work?

A co-pay is a monetary charge that your health insurance plan may require you to the pay in order to receive a specific medical service or supply. Co-pays vary by policy and can change depending on the type of visit.

Example: Let's say Gary goes to a Children’s Colorado specialist with a case of mono. His specialist reviews his insurance and sees that he has a $25 co-pay based on his insurance benefits. His co-pay is collected, and his insurance company will reimburse the specialist for the difference between the co-pay and the cost of treatment.

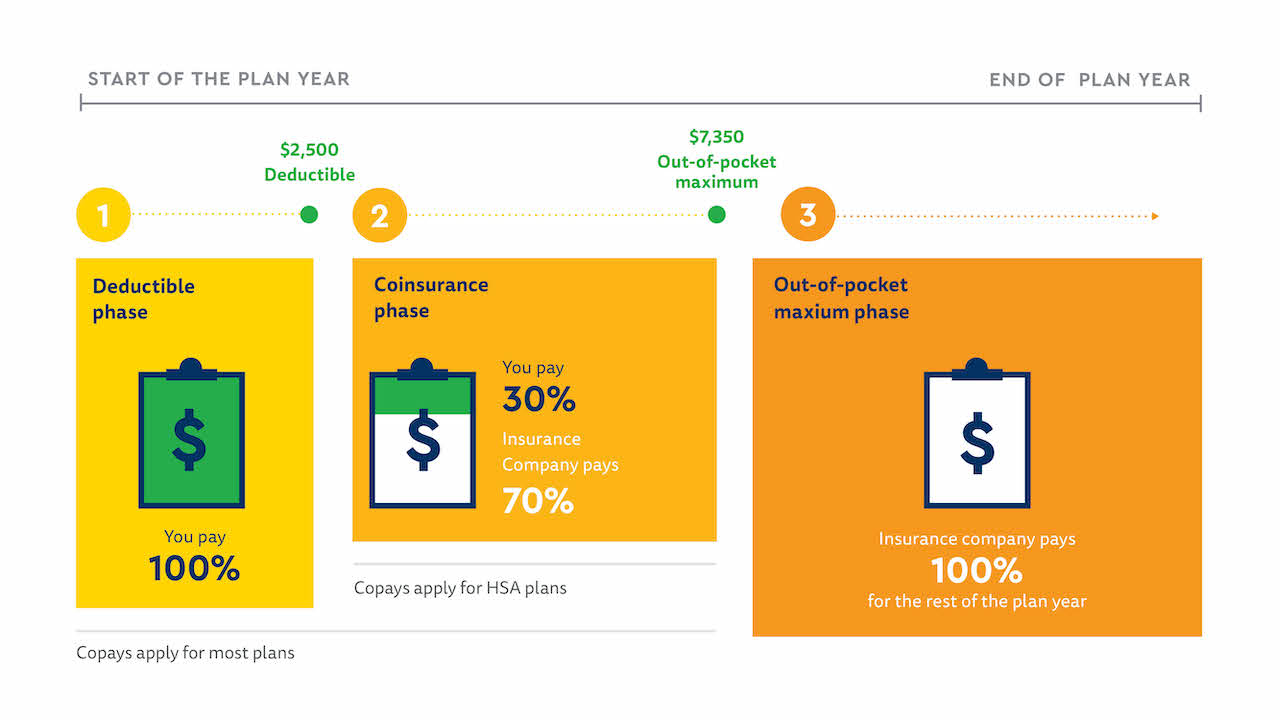

Here's another example: Say your plan’s deductible is $2,500, your plan covers 70% of services and your out-of-pocket max is $7,350. Setting aside copays, here’s what your year looks like:

How do health insurance co-insurances work?

Co-insurance is the way you and your health insurer share the costs of your care. For example, if Gary is injured and he’s met his deductible for the year, his health plan will pay 80% of the cost of his bills, leaving him responsible for the remaining 20%.

How do health insurance deductibles work?

Your deductible is the amount of your medical costs that you have to pay before your health insurance will pay benefits consistent with the benefit plan.

Example: Gary has a health plan with a $1,500 deductible. If Gary only has minor health expenses during the year that cost less than $1,500 total, he's going to pay the full amount to treat them. However, if Gary has a serious illness that requires a lot of medical care, he'll pay his $1,500 deductible and then his health insurance will pay benefits consistent with the benefit plan.

Summary of health insurance deductibles, co-pays and co-insurance

- You pay co-pays when you see the doctor.

- Co-insurance is how you and your insurance company split up the cost of your care.

- Deductibles are the portion you must pay before your insurance pays.

Can I pay my bill online?

Yes, you can pay your hospital bills online through MyChart. You can create an account on MyChart or login as a guest. Your login information is available on the paper statement you received or you can contact Patient Financial Services for help getting set up on MyChart.

To pay your provider bill online, contact University of Colorado Medicine billing (formerly University Physicians, Inc.). You can reach the University of Colorado Medicine billing office at 303-493-7700.

If I pay online, can I get a receipt?

Yes. Once you have paid, a confirmation screen will appear. Select the option to print the receipt.

When do I pay my co-pay, co-insurance or deductible?

Your co-pay, co-insurance or deductible is due when you check in for your visit. If you are unsure of your financial responsibilities, please look at your insurance card or call your insurance company.

How can I pay my balance?

We offer several payment options:

- You can make a one-time payment or set up an automatic monthly payment arrangement for Children’s Colorado online with MyChart. All major credit cards are accepted.

- You can pay by mail. Make the check or money order payable to Children’s Colorado and include your guarantor number.

Mail to:

Children’s Hospital Colorado

PO Box 911611

Denver, CO 80291-1611

Contact our customer service team at 720-777-6422 or pfs@childrenscolorado.org.

What if I can’t pay my bill in full?

You can set up automatic monthly payment arrangements in MyChart or by contacting our Customer Service Department at 720-777-6422 or pfs@childrenscolorado.org.

My child’s medical bills are adding up fast and I can’t afford to pay them. How can I get help?

We are committed to providing health care to children, regardless of family income. Many of our patient families are surprised to learn that their child qualifies for assistance. Please call one of our financial counselors at 720-777-7001 to discuss financial assistance options. Our financial counselors can help you apply for a variety of Financial Assistance Programs.

I made a payment, but I received another billing statement. Why?

The statement could have been generated prior to your payment, but if you have made a payment and received a bill, please contact our customer service team at 720-777-6422 or pfs@childrenscolorado.org and we will be happy to review your payment(s) and any remaining balance(s).

I received a letter stating my account has been referred to a collection agency or collection attorney. Why was this done and what should I do?

Before an account is placed with a collection agency, you will receive three billing statements from Children’s Colorado advising you of your child's account activity. You may also receive phone calls from our billing office personnel during this billing period.

After these steps have been taken and payment or payment arrangements have not been made, the account is then referred to a collection agency. Once an account is placed with an outside collection agency, we ask that parents work directly with the agency to resolve the balance. This is done to minimize confusion and frustration by eliminating unnecessary phone calls for families.

Will you bill the insurance company for my child’s visit?

We will file your claim with the insurance information provided to us during your visit registration. It is very important that you provide us with all the necessary information at the time of registration to ensure that we are billing the correct insurance company within a timely manner

Will you bill both my primary and secondary insurances?

We will bill all of the insurances that you provide to us for each visit. The insurance(s) that we have on file for each visit will be listed on your statement.

How does my insurance company receive the claim for health care services?

Children's Colorado sends the claim to your insurance company. To ensure prompt, proper claim processing, please verify we have the proper insurance information on file when you register.

What is the difference between hospital and physician billing statements?

You may receive separate bills for physician and hospital services. Physician services are billed through CU Medicine and Children's Colorado services are billed through Children's Colorado. For more information, learn more about your bill.

Why do I receive two billing statements when my child only sees a physician at Children’s Colorado?

With most physician-related services performed at our hospital, there is a corresponding Children's Colorado charge. This is because our providers don't work directly for the hospital. Instead, they have privileges to practice at our hospital. Your Children's Colorado bill covers services we provide directly, such as facilities, nursing services and labs. You'll also receive a bill for the doctor's services. Most of our providers bill through CU Medicine.

Why do I receive billing statements from the hospital when my child was never there?

Children's Colorado provides a wide array of medical-related services for independent clinics and physicians, as well as other hospitals. For example, a pediatrician or a free-standing health center may refer lab work to us for testing or analysis. When this occurs, the bill for the lab services will come from Children's Colorado and not the pediatrician or health center.

Take your seat at The Table

We've created a private online community where people like you will get the opportunity to share your thoughts and opinions on a wide range of topics. Your insights will help us improve patient and family amenities, make in-person services safer and more comfortable, enhance our telehealth options and much more.